Dear valued client,

Markets made significant gains this week as trade deals are materializing and tariff reduction is on the horizon. More on that below.

Amid global trade tensions, China is attempting to influence Japan to jointly oppose U.S. tariffs, with Chinese Premier Li Qiang urging Japanese Prime Minister Shigeru Ishiba to “fight protectionism together.” However, Japan, wary of China despite it being its largest trading partner, is prioritizing trade talks with the United States. With Japan’s national security concerns and a critical election looming in July 2025, Tokyo is focused on securing a deal with Washington. China’s overture, seen as a strategic move amid strained U.S. relations, will likely be met with skepticism in Japan, underscoring the complex interplay of economic and geopolitical priorities in the U.S.-China trade war.In an attempt to stabilize financial markets and entice President Xi to the negotiating table, Trump has hinted at a potential de-escalation in the U.S.-China trade war, suggesting that tariffs on Chinese imports could “come down substantially.” Reports indicate the administration is considering reducing the 145% tariff on non-security-related Chinese goods to 35% and lowering the overall rate to 50%, though Treasury Secretary Scott Bessent emphasized that any reductions would require reciprocal actions from China. While negotiations with China have not yet begun, Bessent expressed optimism about reaching a “big deal” that would be favorable for both countries.

Tesla’s first-quarter earnings revealed a 71% plunge in net income and a 9% revenue drop, driven by a 13% decline in vehicle deliveries, intensified competition from Chinese EV makers like BYD, supply chain disruptions, and political backlash against CEO Elon Musk. The company’s stock, already down 41% year-to-date, surged 5% in after-hours trading after Musk announced he would significantly reduce his involvement with DOGE and refocus on Tesla starting next month. However, concerns persist that Musk’s renewed commitment may be too late, with early investor Ross Gerber suggesting a CEO change could be necessary. Tesla also faces potential demand impacts from Trump’s tariffs, alongside plans for a robotaxi rollout and a more affordable model.

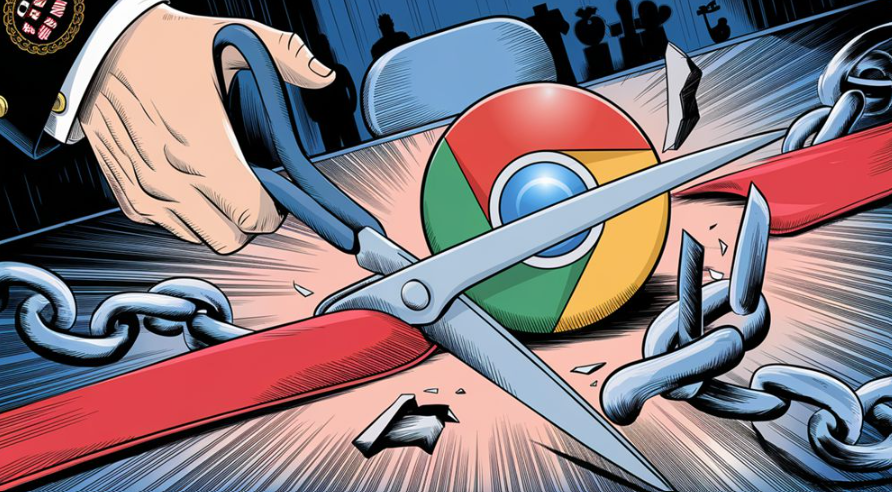

Google faces significant challenges from two U.S. antitrust rulings that found the company illegally monopolized the search and adtech markets, potentially threatening its dominance and raising the possibility of asset divestitures, such as its Chrome browser. Despite the $264 billion spent on Google’s advertising platforms like YouTube and search last year, many marketers are not celebrating the prospect of a breakup. Competitors in the adtech space are the primary advocates for dismantling Google, while chief marketing officers (CMOs) remain largely indifferent, prioritizing immediate concerns like a potential recession, tariffs, and budget cuts over the uncertain fallout of a breakup. Marketers continue to rely on Google’s vast audiences and effective ads, viewing them as indispensable despite desires for greater transparency, with alternatives still unable to match Google’s reach and impact.

Pope Francis, born Jorge Mario Bergoglio, died at 88 on Monday in the Vatican, hours after greeting Easter crowds following a severe bout of pneumonia. The first Jesuit and Latin American pope, known as the “people’s pope,” championed progressive causes, including creating a haven for the homeless and advocating for migrants. The Vatican now prepares for his funeral and a conclave to choose his successor.

“Competition is always a good thing. It forces us to do our best. A monopoly renders people complacent and satisfied with mediocrity.” – Nancy Pearcey

Have a great weekend,

PW