Dear valued client,

Markets took a tumble on Tuesday following August’s inflation data, coming in at 8.3%, slightly lower than July’s 8.5% figures. The 0.2% drop was not enough to convince investors that inflation is comfortably under control. The Federal Reserve will now almost certainly raise interest rates another 0.75 percentage points. Another increase will continue to shrink corporations’ balance sheets and make personal debts (mortgages, lines of credit) that much more expensive.

Many experts believed plummeting fuel prices would push costs down across the economy. Though gas prices have plummeted, down 10.6% in August, it hasn’t had the expected impact on areas like food, rent, medical care, new cars, etc.

The conflict in Ukraine took a positive turn last weekend as Ukrainian forces tripled their territorial gains in only 48 hours. Officials say Russian soldiers ceded roughly 1,100 square miles of the northeastern Kharkiv region. In response, Russian strikes caused a “total blackout” across stretches of eastern Ukraine, per President Zelensky.

Despite the ominous news lately about geopolitics, the economy, and markets, there are still positive trends we should be encouraged about. For instance, the U.S. Census Bureau released a report yesterday indicating the number of U.S. children living in poverty reached its lowest level in modern history last year. 5.2% of children lived in poverty last year compared to 9.7% in 2020. This is a dramatic improvement that should not be under-appreciated as the health of children bears a direct relationship to the future health of society.

King Charles III ascended to the throne this week, and while he’s inherited an enormous responsibility, he’s also inherited equally enormous wealth. This includes a private market portfolio ($949 million), the Crown Estate including land, shopping malls, wind farms, and various castles such as Balmoral Castle in Scotland. In total, the Crown’s assets are deemed to be worth around $28 billion. Let’s just say I wouldn’t mind having King Charles III as a client.

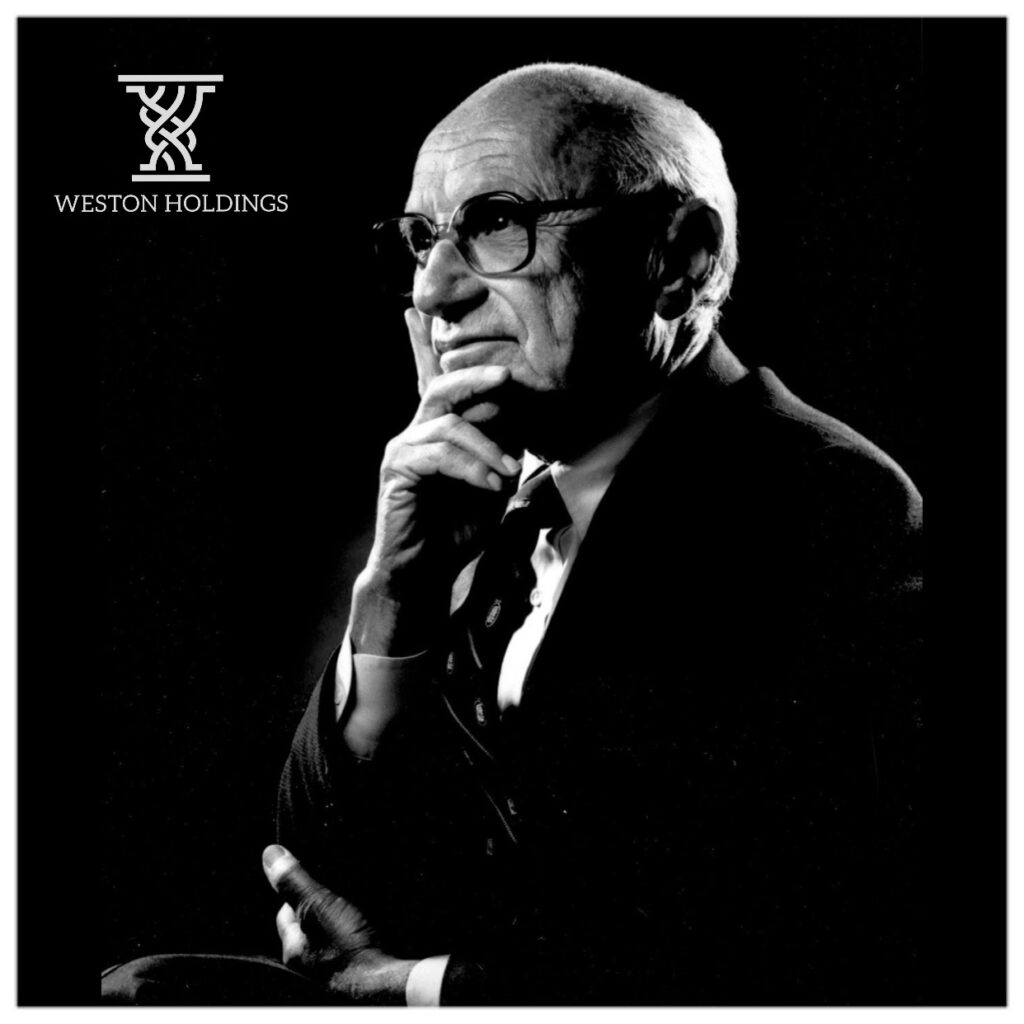

To end this week’s blog, I’d like to share an analogy from the late, great economist Milton Friedman. Friedman taught at the University of Chicago for 30 years and won the Nobel Prize in Economics in 1976. Here’s what he had to say on inflation:

“Inflation is just like alcoholism. In both cases, when you start drinking or when you start printing too much money, the good effects come first and the bad effects only come later. That’s why in both cases, there’s a strong tendency to overdo it – to drink too much and to print too much money. When it comes to the cure, it’s the other way around. When you stop drinking or when you stop printing money, the bad effects come first, and the good effects only come later.”

Have a terrific weekend,

PW

PS. The US News & World Report released its yearly ranking of the best colleges in the country this week. Here’s the top 10:

- Princeton

- MIT

- Harvard

- Stanford

- Yale

- University of Chicago

- Johns Hopkins University

- UPENN

- CalTech

- Duke University