Dear valued client,

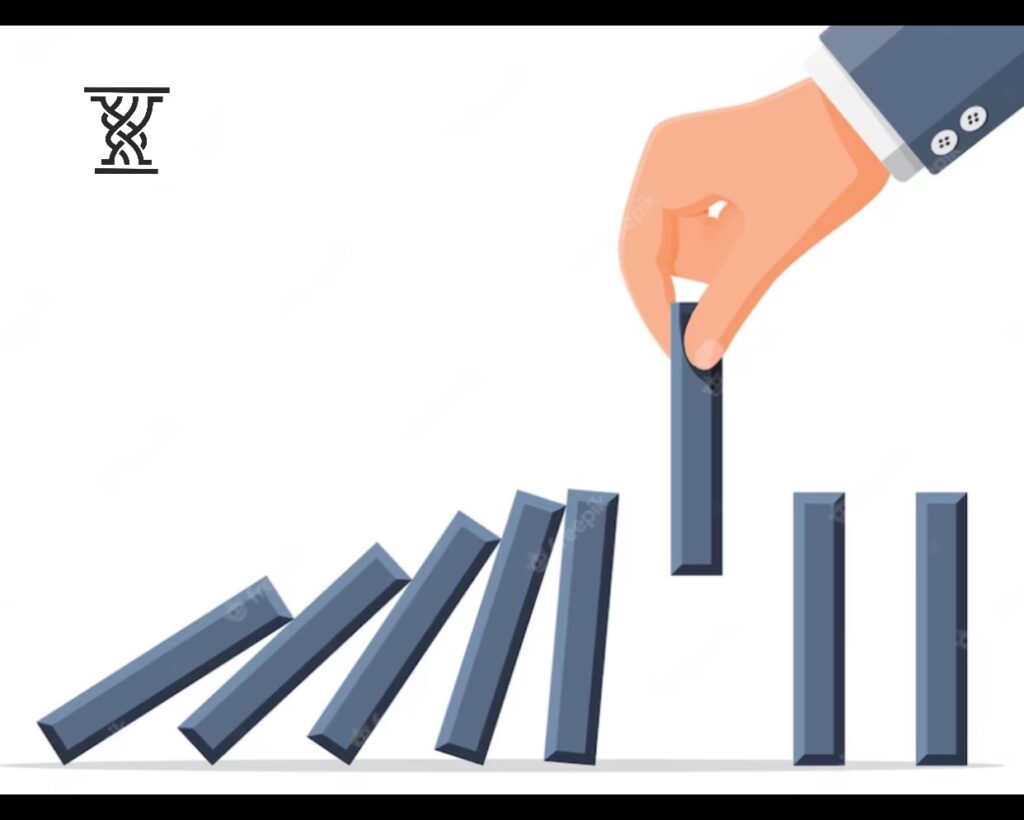

Markets continued to rise this week (1.5%) as investor fears of a banking crisis were assuaged. Regulators stepped in and played a major role in keeping more dominoes from falling after the insolvency of Silicon Valley Bank and Signature Bank in NY last week. Swiss regulators, for instance, helped mediate a deal to have Credit Swiss bought by UBS (Union Bank of Switzerland). Other banks also stepped in with financial aid. A $30 billion deposit infusion from JP Morgan Chase, Bank of America, and other financial giants kept First Republic Bank afloat at the end of last week, strengthening confidence in the U.S. banking system. Whether these helping hands will only postpone dominoes from falling in the future remains to be seen.

The Fed announced an expected 0.25 percentage point increase on Wednesday. Caught between containing inflation (still at 6%) and mitigating further banking worries, they deemed this a fair middle-ground. In the press conference after the announcement, the Chairman indicated the Fed might end their rate-rise campaign sooner than they had thought a few weeks ago.

In geopolitical news, Chinese leader Xi Jinping had a three-day visit with Russian President Vladimir Putin at the beginning of the week. China has called the trip a “journey of friendship, cooperation, and peace.” China has continued to sell microchips and other tech for military use to Russia, but no weapons as of yet. This meeting comes on the heels of the Chinese government helping broker a peace deal between Iran and Saudi Arabia as well as an arrest warrant for Putin issued by the International Criminal Court for alleged war crimes in Ukraine. Mr. Xi is expected to call President Zelensky for the first time since the start of the war after his trip to Moscow.

“Collective fear stimulates herd instinct, and tends to produce ferocity toward those who are not regarded as members of the herd.” – Bertrand Russell

Have a terrific weekend,

PW