Dear valued client,

Markets whiplashed this week, starting strong and changing directions following President Trump’s Rose Garden address (more on that below). The U.S. also reported a significant increase in employment in March, with 228,000 new workers added to the payrolls. This figure greatly exceeded economists’ predictions, which had forecasted a rise of only 140,000 jobs, and it also surpassed February’s revised job growth of 117,000. Despite the robust job gains, the unemployment rate edged up to 4.2%, slightly above expectations and an increase from February’s rate of 4.1%.

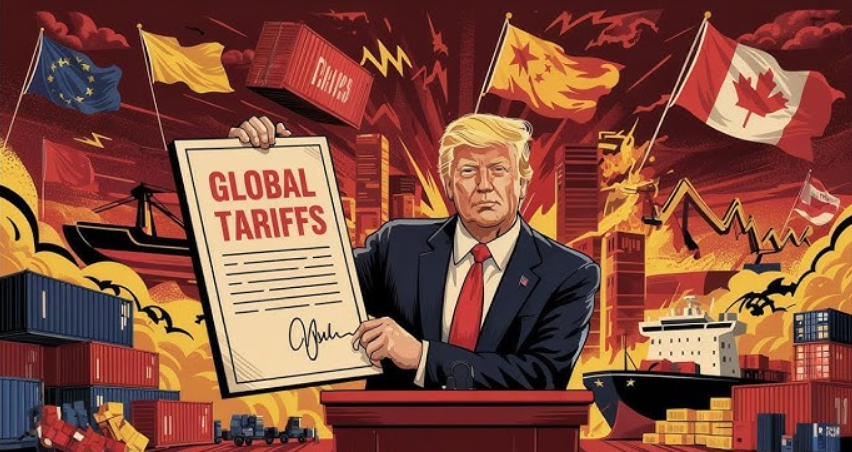

President Donald Trump has introduced sweeping tariffs dubbed “Liberation Day,” implementing a 10% baseline levy on nearly all U.S. imports starting April 5, 2025, with additional reciprocal tariffs effective April 9 targeting countries with significant trade surpluses or high tariffs on American goods. Notable rates include 34% on China (adding to an existing 20% tariff), 46% on Vietnam, 20% on the EU, and 24% on Japan, while a 25% tariff on foreign-made cars and parts took effect immediately. Canada and Mexico are exempt from the new reciprocal tariffs, though existing 25% levies on steel, aluminum, and vehicles remain, with exemptions for goods compliant with the USMCA agreement. Trump’s new tariffs aim to bring manufacturing back to the U.S. and generate revenue to fund tax cuts, fulfilling campaign promises to blue-collar workers and unions like the Teamsters. However, this strategy risks short-term economic challenges, including price hikes and a potential recession, with Trump betting that long-term gains from tax cuts, deregulation, and job growth will materialize before the 2026 midterms.My read is that institutional investors pulled their money from areas in the market that will be hurt the most and will reinvest in sectors/industries/companies that will eventually thrive in this new environment of global commerce. This is a terrific opportunity to buy more shares of quality companies at a discount. In the wise words of Warren Buffett:

“Be fearful when others are greedy and greedy when others are fearful.”

As the Saturday deadline looms for ByteDance, TikTok’s Chinese parent company, to sell the app or face a U.S. ban due to national security concerns, a diverse array of bidders has emerged to acquire the platform, valued at up to $100 billion. Potential buyers include Amazon, mobile tech firm AppLovin, Oracle, private equity giants Andreessen Horowitz and Blackstone, OnlyFans founder Tim Stokely’s startup Zoop (partnered with cryptocurrency foundation Hbar), and even internet personality MrBeast, alongside Project Liberty led by Frank McCourt. President Trump, briefed on a potential deal structure on April 2, 2025, has hinted at linking tariff relief to China’s cooperation or extending the deadline to keep TikTok operational in the U.S., though any agreement hinges on approval from both the White House and China, the latter of which remains uncertain. Among the contenders, a group of private equity investors led by Andreessen Horowitz and Blackstone appears to be the frontrunner, reportedly nearing White House approval.

Nearly three months after Bashar al-Assad’s regime fell, Syria’s new leader, Ahmed al-Sharaa, formerly of the rebel group Hayat Tahrir al-Sham, is navigating a fragile transition following 50 years of dictatorship and a 13-year civil war that left 90% of Syrians in poverty and the economy needing nearly $1 trillion to rebuild. In early 2025, journalist Mark MacKinnon observed a Damascus relatively unscathed compared to devastated areas like Douma. Optimism faded as sectarian clashes killed up to 2,000 people, mostly civilians, amid Israeli airstrikes and fighting with Assad loyalists. Al-Sharaa’s new cabinet aims to ease Western sanctions – already partially lifted by Europe and Canada – but U.S. restrictions persist, complicating recovery. Foreign powers like Turkey, eyeing influence with military bases, and Israel, countering Iran’s past foothold, add volatility, while Russia may retain bases despite sheltering Assad, highlighting Syria’s precarious path forward.

“The first lesson of economics is scarcity: there is never enough of anything to fully satisfy all those who want it. The first lesson of politics is to disregard the first lesson of economics.” – Thomas Sowell

Have a great weekend,

PW