War Erupts in the Middle East

Dear valued client, Markets posted gains this week despite war breaking out in the Middle East. I will refrain from commenting on the history of the Israeli-Palestinian conflict as my ignorance far surpasses my knowledge on the subject. I will share the objective facts as I have read them and comment on how the conflict […]

SBF Pointing Fingers

Dear valued client, Markets started the week in mixed fashion and ended with gains of roughly 0.5% amid political turnover both on the Canadian and American side of the border. Canadian House Speaker Anthony Rota stepped down from his position after mistakenly inviting and honoring a former SS Nazi in the House of Commons last week. […]

Say WHAT?

Dear valued client, Markets continued their lackluster month of September with another week of slight losses amid a backdrop of a looming U.S. government shutdown, a weakening labor market, and consumer headwinds. On a positive note, the revised U.S. GDP for the second quarter of 2023 came in at 2.1%, showing the economy continued to […]

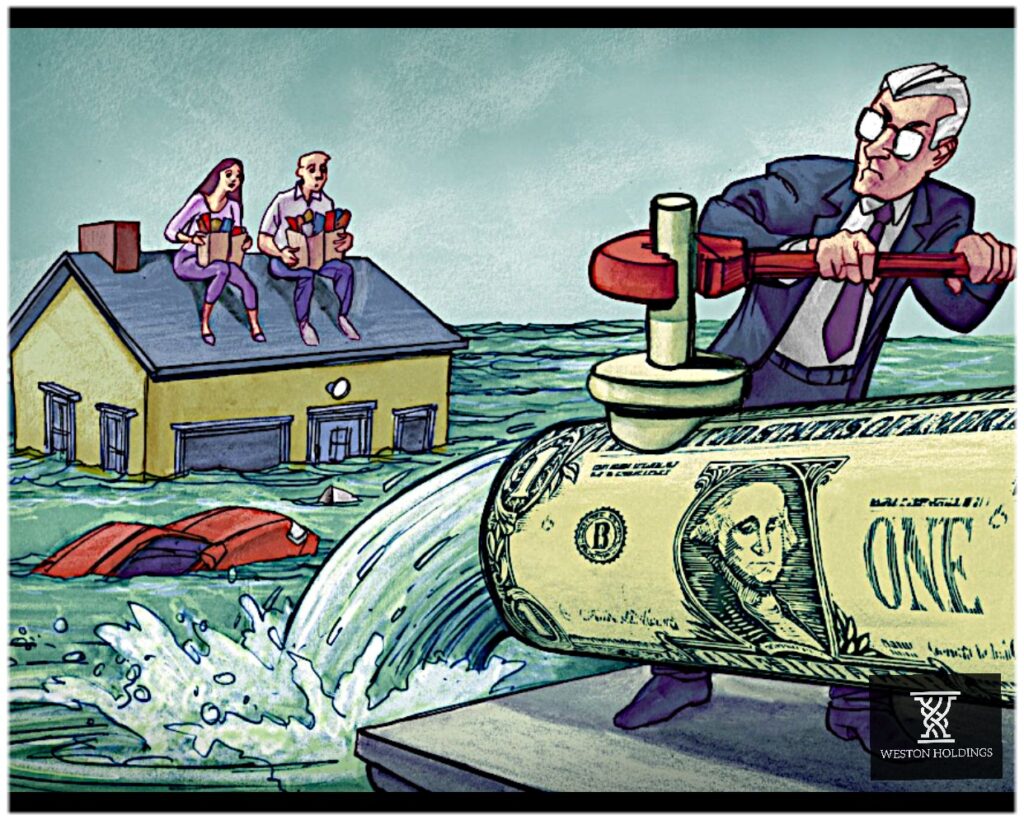

Fed Holds Steady

Dear valued client, Markets slipped this week as the Federal Reserve decided to hold interest rates steady at 5.25-5.50%. Given Jerome Powell’s comments following the decision, experts expect one more rate hike before the end of the year, which would bring the federal funds rate close to 6%. Following in the U.S.’s footsteps (whose median […]

(Legal) Heavyweight Showdown

Dear valued client, Markets lost slight ground this week as Apple launched its new iPhone 15 (with a new charging port – surprised, surprised), and U.S. inflation numbers were released. The CPI came in at 3.7%, higher than in July (3.2%) and June (3%). This uptick in prices dramatically increases the odds of one more rate […]

BofC hits the Pause Button

Dear valued client, Canadians let out a sigh of relief this week when Tiff Macklem announced the Bank of Canada is holding its interest rate steady at 5%. The rationale behind the decision is that, by most metrics, the economy is showing signs of cooling. The move was expected and already priced into the market […]

What is Genuine Freedom?

Dear valued client, Markets finished with gains (+2.5%) this week to close a rather sluggish month for equities. Despite the light week in terms of economic news, there were two noteworthy reports released; (1) According to the National Association of Realtors, U.S. pending home sales ticked up in July by 0.9%, rising for the second […]

Coincidence…?

Dear valued client, Markets posted slight gains this week in light of the fact that Nvidia, one of the largest semiconductor manufacturers and an AI vanguard, posted outstanding second-quarter earnings: $13.51 billion in revenue. This positive development was somewhat nullified by remarks delivered from Federal Reserve officials in Jackson Hole, Wyoming stating the economy hasn’t […]

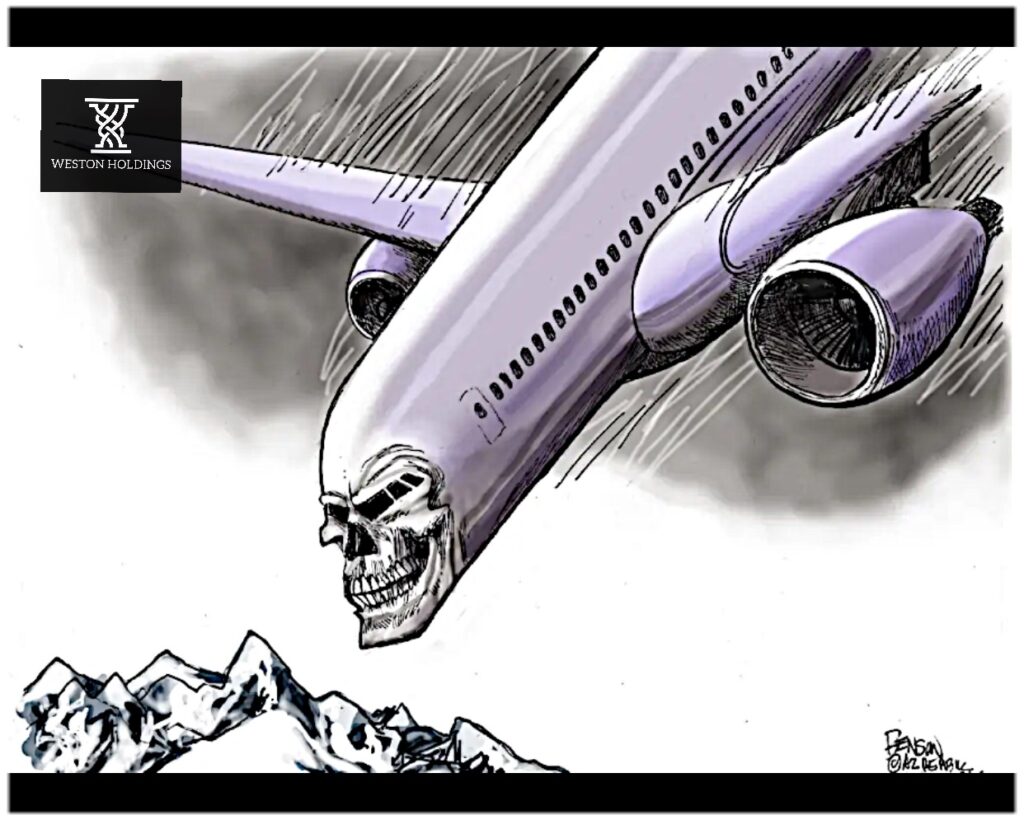

Hawaii in Ashes

Dear valued client, The strong possibility of another interest rate hike pulled markets down this week. Canadian inflation came in at 3.3% for the month of July (compared to 2.8% in June). This, the hawkish tone from Federal Reserve monetary policymakers, as well as gas prices rising to their highest level since Oct. 2022, indicates […]

One Trillion… with a “T”

Dear valued client, Markets closed the week with slight losses as the U.S. July inflation report (3.2%) came in slightly higher than in June (3%). Elevated gasoline prices are the main culprit for the uptick as OPEC continues to limit its oil output. Another factor making inflation sticky is the growth in average hourly wages, which […]