Text mining and semantics: a systematic mapping study Journal of the Brazilian Computer Society Full Text

Text & Semantic Analysis Machine Learning with Python by SHAMIT BAGCHI Semantic analysis is key to contextualization that helps disambiguate language data so text-based NLP applications can be more accurate. It’s not just about understanding text; it’s about inferring intent, unraveling emotions, and enabling machines to interpret human communication with remarkable accuracy and depth. From […]

Tough Start for Japan

Dear valued client, Markets lost ground in a shortened trading week to kick off 2024. Israel pulled back from their offensive in Gaza to redirect their efforts in other parts of the region with the killing of Saleh al-Arouri, Hamas’ deputy political leader and co-founder of its military wing, in a drone strike this week […]

Housing Costs in Canada

Dear valued client, Markets rose yet again this week on news that inflation in Canada was a steady 3.1% in November (compared to 3.1% in October and 3.8% in September). The good news is inflation did not increase. The less optimistic news is that housing prices continue to rise. In a speech at Toronto’s Royal York Hotel […]

Inflation Continues to Deflate

Dear valued client, Markets rose yet again this week as inflation in the U.S. continues to dissipate. CPI figures for November came in at 3.1% (compared to 3.2% in October and 3.7% in September). The Federal Reserve, as expected, decided to hold the overnight lending rate at 5.25-5.5% in its meeting Wednesday. This development is […]

The Big Short 2.0 – Israeli Edition

Dear valued client, ** Please note RRSP season (Jan/Feb) is quickly approaching. If you would like to get together to review your tax situation for the year and strategize on how to save as much as possible on income tax, please get in touch with me to schedule a meeting. ** Markets were mixed this […]

New Argentinian Sheriff in Town

Dear valued client, More gains were locked in this week as Statistics Canada reported another drop in inflation this week; the CPI came in at 3.1% in October (compared to 3.8% in Sept. and 4% in August). Inflation seems to be subsiding globally as well; for instance, the U.K., which reported a CPI of 10.1% at […]

World Powers make Progress?

Dear valued client, Markets posted gains for the third week in a row as companies posted strong Q3 earnings reports and optimism is permeating across Wall Street about the possibility that interest rates have hit their peak. This sentiment was reinforced this week when the U.S. inflation report came in at 3.2% (compared to 3.7% […]

Guilty On All Counts

Dear valued client, Both Canadian and American markets had major rallies this week posting gains of 5.7% and 5.75% respectively after several weeks of sell-offs. Following the Federal Open Market Committee’s meeting on Wednesday, the U.S. central bank decided to hold interest rates steady at 5.25-5.5%. Jerome Powell made it clear another interest rate hike […]

What Is Conversational AI? NVIDIA Blog

What Is A Key Differentiator of Conversational Artificial Intelligence Ai? But what is the benefit to those of us who are content with our organic relationships? We can look forward to validating the assumption that conversation is a more intuitive interface. It seems plausible because a few core components of the WIMP paradigm have well-documented […]

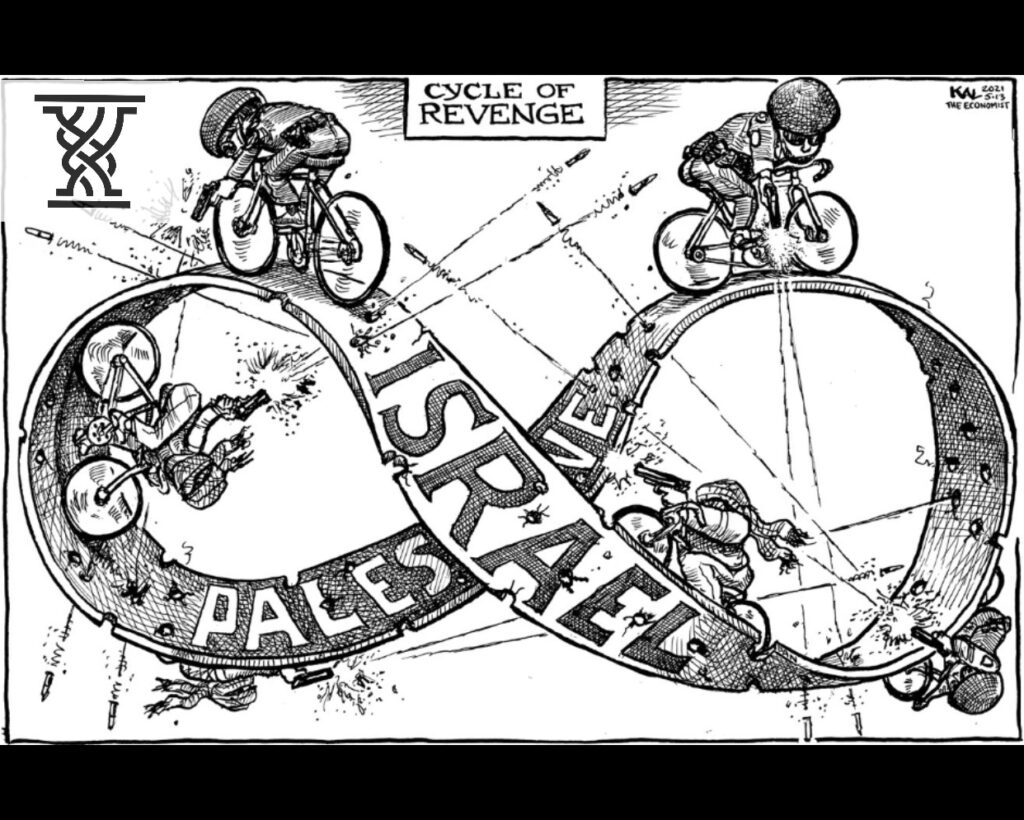

Cycle of Revenge

Dear valued client, Markets dropped slightly this week as the war in the Middle East entered its second week. Palestinian causalities continued to mount in Gaza and even more Palestinians are gathered on the Egyptian border as water and supplies have been cut off from the region. President Joe Biden made a visit to Israel […]