Buybacks are Back in Fashion

Dear valued client, Markets lost some ground this week as U.S. inflation saw a slight uptick in February, coming in at 3.2% (compared to 3.1% in January and 3.4% in December), surpassing economists’ expectations of 3.1%, according to the recent report from the Labor Department. This marks the second consecutive month of inflation surpassing forecasts, reinforcing […]

Apple’s 2 Billion Dollar Ticket

Dear valued client, Markets remained relatively flat this week after a terrific start to 2024. The Bank of Canada held interest rates steady this week, demonstrating a commitment to stability despite fluctuations in inflation figures. This decision marks the fifth consecutive time the central bank has opted to maintain the benchmark interest rate. Despite speculation, […]

Orwellian Online Bill

Dear valued client,Markets finished in positive territory again this week, reaching new all-time highs. After a lull in 2022-23, IPOs are on the rise again. Reddit, the platform renowned for catalyzing meme stocks, is set to go public, marking a significant shift for the company. Unlike traditional IPOs, Reddit plans to offer 75,000 of its dedicated users […]

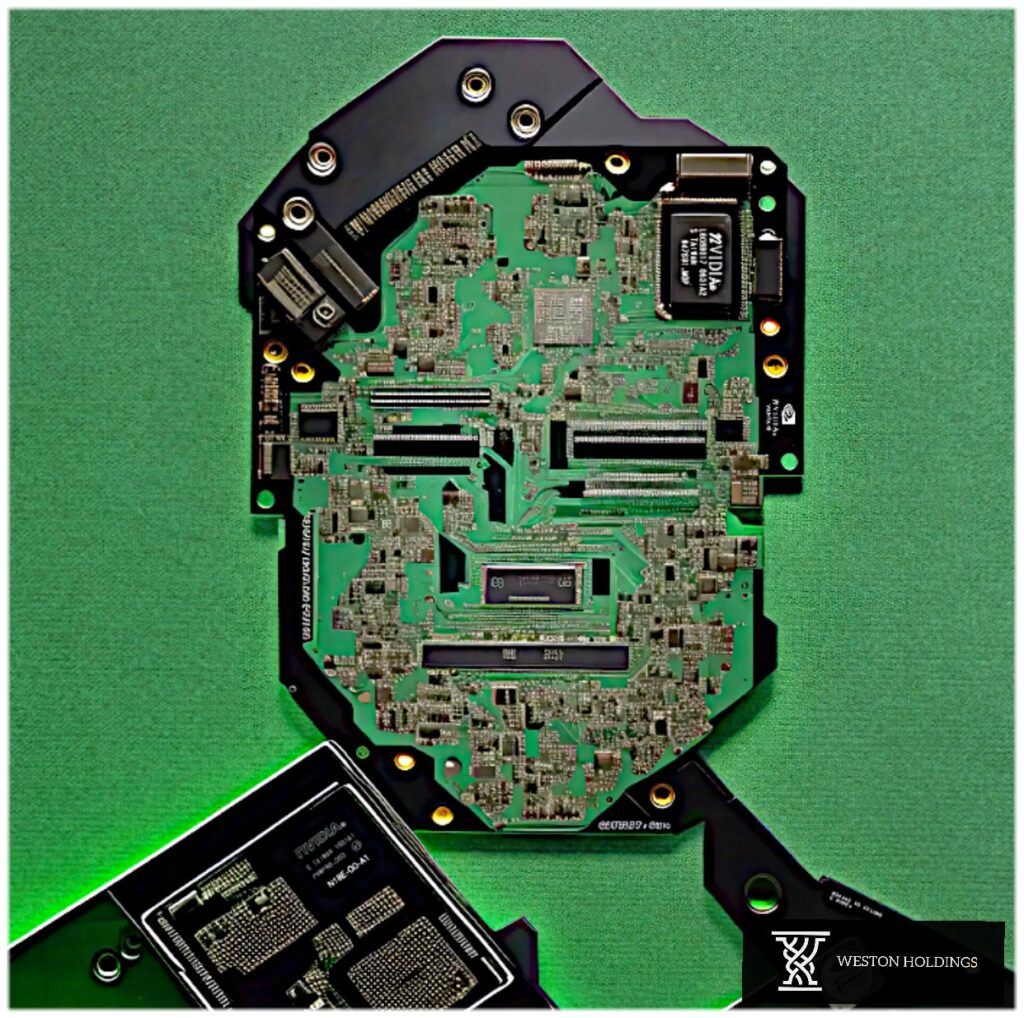

Nvidia’s Hot (Micro)chips

Dear valued client, Markets finished in positive territory this week, catalyzed by Nvidia’s earnings. The chipmaker’s highly anticipated earnings report exceeded expectations, showcasing the impressive growth of the AI revolution. With quarterly sales soaring to $22.1 billion, a remarkable 265% increase from the previous year, and net profit reaching $12.3 billion, Nvidia’s performance solidified its position […]

Inflation Concerns, Gaza Conflict Escalation, and ArriveCan Controversy

Dear valued client, Markets declined slightly this week after a downturn on Tuesday following the release of the U.S.’s higher-than-expected inflation report. Inflation, though not as rampant as in 2022, still lingers, with prices not meeting Jerome Powell’s expectations. Consumer price index data came in at 3.1% in January (compared to 3.4% in December and […]

Will the Real ‘Satoshi Nakamoto’ Please Stand Up

Dear valued client, Markets reached new all-time highs this week buoyed by better-than-expected corporate earnings reports. Companies such as McDonald’s, Chipotle, Eli Lilly, CVS, Caterpillar, GM, and United Rentals posted strong top-line figures and the market responded accordingly. Shares of Disney, for instance, did particularly well after they announced taking a $1.5 billion equity stake […]

$54 Million for What Exactly?

Dear valued client, The Federal Reserve left rates unchanged following their meeting on Wednesday and dismissed expectations of a rate cut by March. Fed Chair Jerome Powell expressed skepticism, stating that the Fed is unlikely to have sufficient confidence in mitigating rising prices to implement rate reductions so soon but acknowledged the possibility of cuts later in […]

Court Rules Trudeau Gov’t Abused its Power

Dear valued client, Canadians let out a sigh of relief this week when the Bank of Canada decided to hold interest rates steady at 5% for the fourth consecutive time. It also shifted away from notions of further rate hikes and offered hope of possible rate cuts in the first half of 2024. This is, […]

Another Trump Presidency on the Horizon?

Dear valued client, Markets found more solid ground this week despite investors being concerned Central Banks might not cut rates as soon as they’d hoped. More evidence of this appeared with elevated Canadian inflation numbers; the CPI came in at 3.4% in December – exactly on par with the U.S. – compared to 3.1% in […]

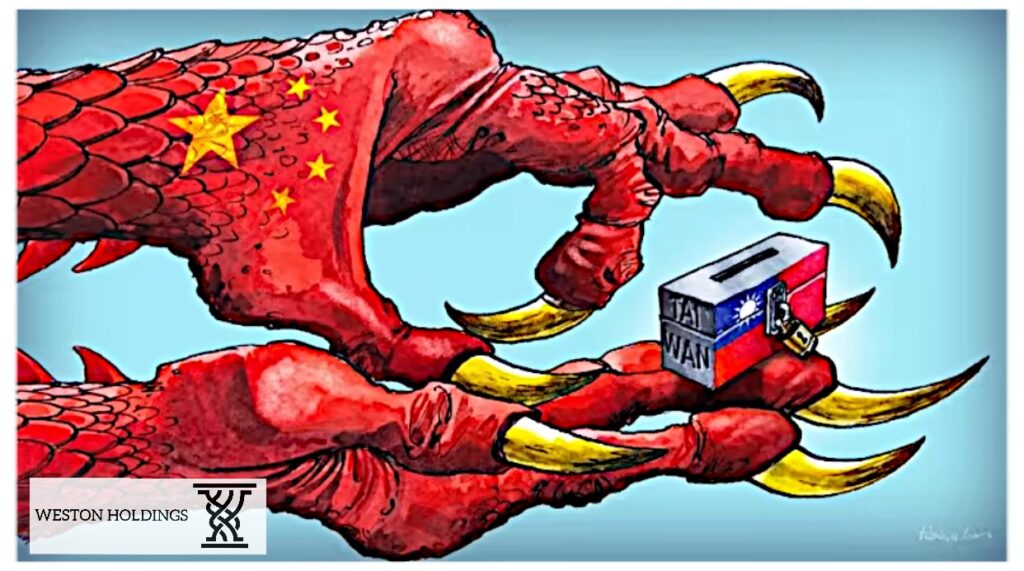

Test of Democracy in Taiwan

Dear valued client, Markets regained the losses from last week despite higher inflation numbers published Thursday. U.S. inflation figures came in at 3.4% for December (compared to 3.1% in November and 3.2% in October). This uptick in prices was driven mainly by rising housing costs after an overall rapid cooling through most of 2023. The […]