Market Rebound

Dear valued client, Markets finished relatively flat following a week of above-average volatility. After tumbling on Monday, the main indices recovered all their losses to close out the week where they started. Cycles in the stock market and the economy at large are inevitable, typically following a sequence of growth, peak, sell-off, and recovery. Market […]

Rate Cuts on the Table

Dear valued client,Following their two-day meeting on Wednesday, the Federal Reserve announced rates will remain unchanged for the time being. Chairman Jerome Powell was unusually revelatory in this statement following the decision, saying, “We’re getting closer to the point at which it’ll be appropriate to reduce our policy rate, but we’re not quite at that point.” […]

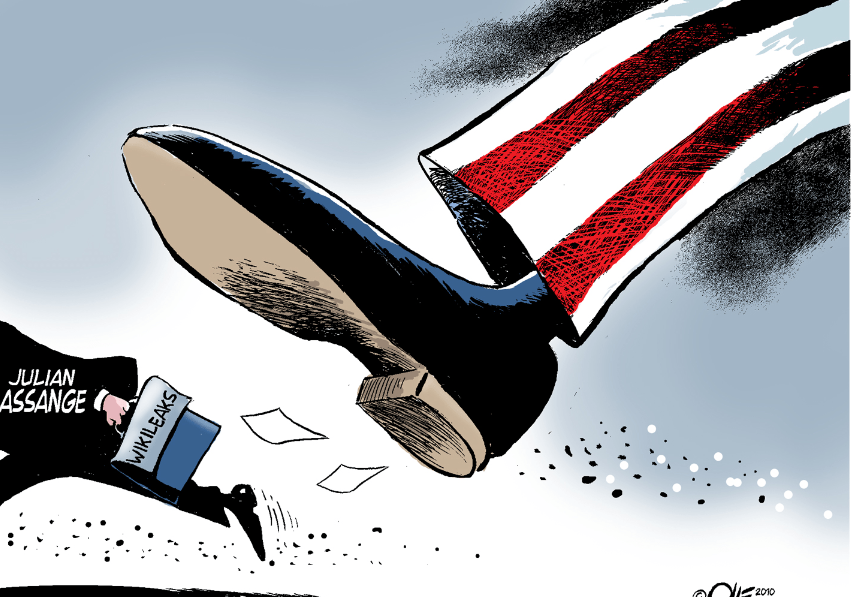

Extreme Form of Censorship

Dear valued client,Markets lost ground following a week of intense political news. In a shocking event last weekend, 20-year-old Thomas Matthew Crooks attempted to assassinate former President Donald Trump at a rally in Butler, Pennsylvania. Crooks, the son of behavioral health counselors and had no prior criminal record, fired multiple shots from the roof of a […]

Inflation Eases, Rate Cuts on the Table

Dear valued client, Markets are on track for more gains this week following reassuring inflation data. The U.S. CPI came in at 3% in June (compared to 3.3% in May and 3.4% in April). Fed Chair Jerome Powell, while addressing Congress, noted progress in reducing inflation and a cooling job market but didn’t comment on […]

The World is a Mirror

Dear valued client,Markets rose again in a shortened trading week for American Independence Day. We are past the halfway mark of 2024, and in the first half of the year, the stock market saw impressive gains, with the S&P 500 rising 15%, largely driven by Nvidia’s 150% surge. Despite no interest rate cuts from the Federal […]

Notorious Whistleblower Released

Dear valued client,Markets rose again this week despite an uptick in inflation figures. According to Statistics Canada, inflation increased to 2.9% in May (compared to 2.7% in April). This acceleration broke a four-month trend of easing price pressures and complicates the Bank of Canada’s future decisions on interest rates, following a recent cut to 4.75%. This […]

The Ultimate Guide

Dear valued client,Markets sustained its strong performance adding modest gains. This week was light on any pertinent economic announcements. A new Abacus Data poll indicates potential trouble for the Trudeau government, with the Liberals projected to secure only 22% of the popular vote and potentially fall to fourth place in the House of Commons with just 37 seats […]

U.S. Inflation Cools, Rates Remain Unchanged

Dear valued client,Markets reached new all-time highs (again) this week following U.S. inflation figures. The CPI came in at 3.3% south of the border in May (compared to 3.4% in April and 3.5% in March). Despite cooling inflation, the Federal Reserve remains cautious. Interest rates held steady at a 23-year high of 5.25%–5.5% for the seventh […]

Canada Cuts Interest Rates

Dear valued client,The Bank of Canada cut interest rates this week and markets responded positively. Rates were reduced for the first time in four years, down from 5% to 4.75%. This decision marks a turning point after rapid rate hikes and significant inflation. Governor Tiff Macklem cited easing inflation as the reason for the cut, […]

The Most Important Work You Can Do

Dear valued client,Despite markets dropping slightly this week, optimism was demonstrated on the consumer side of the economics equation as consumer confidence rose for the first time in four months, with the Conference Board’s monthly index showing an increase from 97.5 in April to 102 in May, surpassing economists’ estimates. The expectations index, reflecting the short-term outlook for […]