2024 Review

Dear valued client,I hope you all had wonderful Christmas celebrations. ** A reminder that RRSP season is around the corner. The deadline for contributions this year is March 3rd. **Markets finished up slightly this week as 2024 was marked by significant global and domestic turmoil, with events that reshaped political and social landscapes. On the international […]

Political Pandemonium

Dear valued client,Markets experienced a selloff this week as the Federal Reserve implemented its third consecutive quarter-point rate cut. However, the outlook for 2025 remains uncertain due to persistent inflation and potential economic shifts under the incoming Trump administration. While the Fed previously projected four rate cuts for 2025, that number has now been revised […]

Regime Change

Dear valued client,Markets are on track to finish relatively flat this week as the Bank of Canada cut interest rates by 50 basis points to 3.25% reflecting ongoing efforts to stimulate the economy amid shifting conditions. While this marks the second consecutive jumbo-sized cut, economists suggest a shift in strategy going forward. Stephen Brown of […]

16+ for Social Media

Dear valued client,** Please note RRSP season is just around the corner. If you would like to get together in the New Year to discuss your tax situation for 2024, please get in touch with me. **Markets finished in the green again this week following a U.S. jobs report showing a stronger-than-expected increase of 227,000 jobs, […]

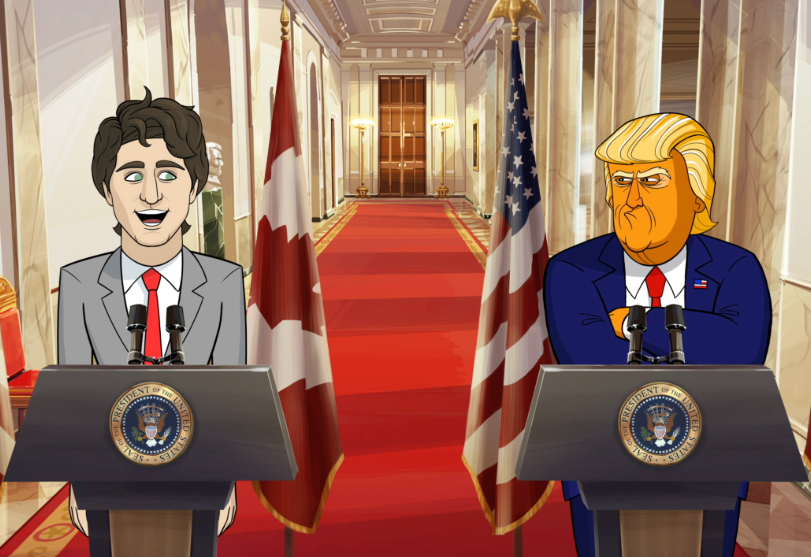

Tariffs on the Menu

Dear valued client,Markets are on track for more gains in a shortened trading week in the U.S. for Thanksgiving. President-elect Donald Trump’s sweeping tariff proposals could have significant economic consequences for Canada, the U.S.’s second-largest trading partner. Trump announced a 25% tariff on all Canadian imports, accusing the country of failing to curb migration and drug […]

1000 Days and Counting

Dear valued client,Markets finished higher this week as Canadian inflation rose slightly in October to 2% (compared to 1.6% in September) which complicates expectations for the Bank of Canada’s next interest rate decision. Investors have reduced the likelihood of another 50 basis-point rate cut in December, now estimating the odds at one in three. While some […]

COP29

Dear valued client, Markets finished lower this week as October’s inflation figures were reported. The CPI ticked up slightly to 2.6% (compared to 2.4% in September and 2.5% in August), aligning with market expectations. This was the first rise in inflation in seven months, mainly because energy prices didn’t drop as much as they had […]

History Often Rhymes

Dear valued client,Markets rose to all-time highs this week following Fed Chair Jerome Powell’s announcement of a one-quarter-point interest rate cut, bringing short-term interest rates to 4.50%-4.75%. This follows a more significant 50-basis-point reduction in September, as Powell aims to curb inflation while sustaining economic stability. If economic data supports continued stability, investors and economists […]

Unintended Consequences

Dear valued client, Markets lost slight ground this week amid a flood of big tech earnings reports. Alphabet, Microsoft, Meta, Apple, and Amazon reported strong Q3 figures. Alphabet led with $88.27 billion in revenue. However, many tech companies – Microsoft and Meta especially – face investor pushback over substantial AI expenditures. Microsoft’s spending surged to $14.9 billion, a […]

Lights Out in Cuba

Dear valued client,Markets are on track to finish relatively flat this week after the Bank of Canada cut its interest rate by half a percentage point to 3.75%, marking its fourth consecutive rate reduction. This move signals that inflation is under control, with the bank aiming to return borrowing costs to a neutral level to […]