Strikes in Iran

Dear valued client,Markets slid into negative territory this week as the U.S. inflation rate came in at 2.4% in May (compared to 2.3% in April and 2.4% in March), marking the first increase in four months but remaining below expectations of 2.5%. Energy costs continued to decline, with gasoline and fuel oil dropping 12% and 8.6%, […]

Meta Goes Nuclear

Dear valued client,Markets moved higher this week as the Bank of Canada maintained its interest rate at 2.75% for the second consecutive time, citing heightened uncertainty from U.S. trade policies, particularly new 50% duties on steel and aluminum imports, and rising inflation pressures. Governor Tiff Macklem highlighted the unpredictability of global trade disruptions, which could […]

Bitcoin on the Balance Sheet

Dear valued client,Markets gained more ground this week as several key companies reported their Q1 earnings. Nvidia, for instance, reported a robust financial performance, posting a $18.8 billion profit, up 26% year-over-year, despite U.S. restrictions barring chip sales to China, a major global market. CEO Jensen Huang remains optimistic, forecasting $45 billion in revenue for the […]

Unworthy of AAA

Dear valued client,Markets lost some of the hefty gains from last week as Canada’s inflation rate dropped to 1.7% in April (compared to 2.3% in March and 2.6% in February), largely due to the elimination of the consumer carbon tax and declining energy prices. Gasoline and natural gas fell 18.1% and 14.1% year-over-year, respectively, amid […]

Embrace Possibility Thinking

Dear valued client,Markets closed out their second best week of the year as inflation in the U.S. dropped to 2.3% in April (compared to 2.4% in March and 2.8% in February), coming in below expectations and driven mostly by energy prices falling 3.7%. Walmart, on the other hand, expressed more caution in their earnings report this week announcing […]

Homage to the Oracle of Omaha

Dear valued client,Markets lost marginal ground this week as the U.S. Federal Reserve maintained its key interest rate at 4.25%–4.5% on Wednesday for the third consecutive time, amidst significant economic uncertainty driven by global trade. Despite a robust economy evidenced by recent employment and spending growth, Powell noted a record-low consumer optimism due to anticipated tariff impacts. Powell has emphasized a […]

A ‘Critical’ Week for Ukraine

Dear valued client,Markets made significant gains this week as the U.S. Bureau of Labor Statistics reported a robust addition of 177,000 jobs, surpassing economists’ expectations of 133,000. Despite ongoing international trade disputes, the unemployment rate held steady at 4.2%, aligning with estimates and the prior month. Corporate leaders, cautious due to tariff-related concerns, are adopting a conservative […]

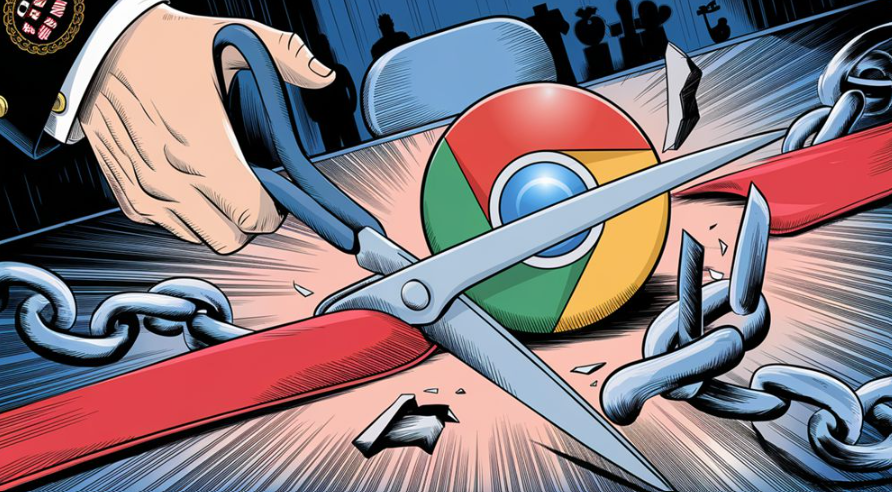

Potential Google Break-Up

Dear valued client,Markets made significant gains this week as trade deals are materializing and tariff reduction is on the horizon. More on that below.Amid global trade tensions, China is attempting to influence Japan to jointly oppose U.S. tariffs, with Chinese Premier Li Qiang urging Japanese Prime Minister Shigeru Ishiba to “fight protectionism together.” However, Japan, […]

Trade Deal Harbinger

Dear valued client,Markets remained choppy this shorter week while investors wait for clarity on trade policy. The Bank of Canada maintained its interest rate at 2.75% amid uncertainty over trade disputes, which could disrupt Canadian trade and economic stability. Governor Tiff Macklem noted that while a rate cut was considered, the bank opted to hold steady to […]

(Chinese) Empire Strikes Back

Dear valued client,Markets gained significant ground this week with its best single-day performance since 2008 on Wednesday after the White House announced a 90-day reciprocal tariff pause. The U.S. also released encouraging inflation figures for the month of March, coming in at 2.4% (compared to 2.8% in February and 3% in January), the lowest it’s […]