Dear valued client,

Elon pulled it off! The multi-billionaire secured a deal to buy Twitter for $44B. Approximately $21B of the funding will come from Musk’s personal wealth while the remaining $23B will be financed by several renowned banks, including Morgan Stanley, Barclays, and Bank of America. Tesla stock dropped roughly 12% since the announcement was made as some shareholders are nervous Musk will not be as devoted to the company’s forthcoming projects. The Twitter transaction is said to take up to 6 months to finalize. We could see the social media platform run privately by the world’s wealthiest individual by October 2022. Here are some of the changes to Twitter Musk intends to make: create an edit button, introduce long-form tweets, eliminate spambots, and open-source the platform’s algorithm for feedback and improvement.

(Interest rate thought experiment… say, for instance, Musk secured his $23B loan at a 2% rate. His annual interest payments alone would be $460M. If rates were to increase to 3%, his annual interest payments would be $690M. If – in our hypothetical world – rates increased to 5%, annual interest payments would amount to $1.15B. Again, these are only interest payments, without repayments on the principal amount. This is what is meant when it is said, “higher interest rates make capital more expensive.”)

Earnings season is in full swing as several blue-chip companies in the U.S. have reported their quarterly numbers. Many reports have beaten Wall Street expectations (including Meta Platforms, Microsoft, Google, and Qualcomm) helping to stabilize the market this week.

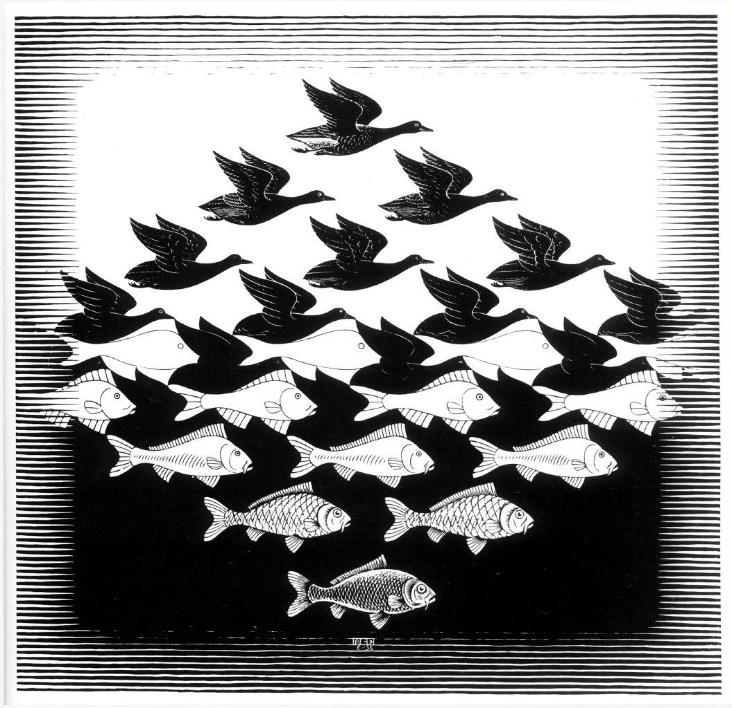

My sense is that there are two main (and interlinked) forces driving inflation at the moment; high demand (consumer behavior) and supply chain disruptions (Russia, Ukraine, China). The strong earnings we’ve seen from major companies speak to demand still being vibrant. I hope both the Federal Reserve and The Bank of Canada take a gentler approach to interest rates – being too aggressive would likely incentivize consumers to pull back, creating cracks in a hull keeping the market afloat at the moment. This would require organic alleviation (or reorganization) of supply chain disruptions, which would entail inflation lasting longer than we might like. Mitigated global supply chains would also obviously aid in supplying the unrelenting demand the market is experiencing. This, in my mind, would be a safer and more beneficial solution for central bankers (easier said than done). Much preferable to a recession. Patience is key.

In basketball news, the first round of the NBA playoffs is well underway. I’ve been most impressed with the Boston Celtics thus far sweeping the Brooklyn Nets quite convincingly, even coming back from 17 points down in game 2. The Nets were some pundits’ favorite to win the championship this year. If Jayson Tatum continues his high level of play, I expect the Celtics to make a serious run.

Have a terrific weekend.

PW

“Patience and perseverance have a magical effect before which difficulties disappear and obstacles vanish.” – John Quincy Adams