Dear valued client,

** Please note RRSP season (Jan/Feb) is quickly approaching. If you would like to get together to review your tax situation for the year and strategize on how to save as much as possible on income tax, please get in touch with me to schedule a meeting. **

Markets were mixed this week (American markets slightly up, Canadian markets slightly down) after steady gains in November.

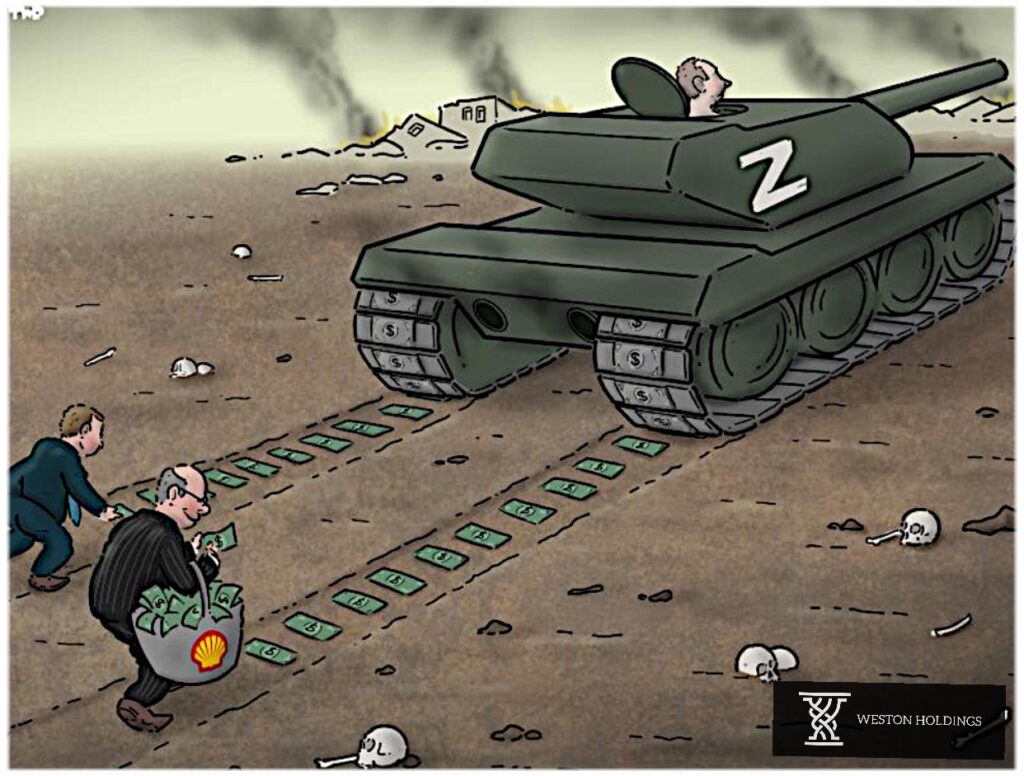

The Bank of Canada announced, as expected, to keep interest rates steady at 5% on Wednesday for the third consecutive and final decision of 2023. Many pundits are predicting rate cuts could start as early as Q2 of 2024, assuming inflation continues to dissipate. Plenty can happen, however, between now and then especially considering the ongoing military conflicts around the world.

Israel resumed attacks and expanded its ground offensive in Gaza following a week-long ceasefire.

An investigation is underway after a pair of U.S. law professors from Columbia and New York University found that bets against Israeli companies spiked before Hamas’ October 7th attack, suggesting some investors knew it was coming. The professors’ 70-page report states, “Our findings suggest that traders informed about the coming attacks profited from these tragic events.” Although Israel has a lot on its plate at the moment, suspicious financial activity such as this will nonetheless be thoroughly investigated.

In other news:

- University Presidents at Harvard, MIT, and UPenn are facing backlash following their rather lenient stances in a Congressional hearing this week on calls for the “genocide of Jews” on their campuses. Many big donors are pulling funding and demanding their resignation.

- Mark Cuban sold the Dallas Mavericks for $3.5B after buying the team for $285M in 2000. That’s an 1128% return on investment. He’s also retaining control of basketball operations.

- The U.S. employment report showed 199,000 jobs were added to the economy in November, bringing the unemployment rate down to 3.7% compared to 3.9% a month prior.

I’d like to close with a passage from the Daily Stoic newsletter about the most valuable real estate there is…

“People spend a lot of money to buy nice land. They want to be in a good neighborhood with good schools. They want to have a beautiful view. Just look at what happened during the pandemic when people rushed to outbid each other for houses outside of major cities–because they wanted safety and space and a change of scenery. For centuries, armies have clashed over territory–some of it valuable, some of it not–willing to pay in blood for control over a piece of dirt.

Meanwhile, some of the most valuable real estate in the world sits, ignored. What’s that? We referred to it as “the empire between your ears.” How many people spend an enormous amount to keep up their estates, but then let their brain fall into disrepair? How many of them protect their property, as Seneca said, but let people waste their time or influence their choices?

Yes, land is valuable–they aren’t making more of it, after all. Yes, you want to have a roof over your head. Yes, nations must protect their sovereign territory. But the Stoics remind us that the greatest empire is within us, between our ears, inside that mushy muscle that is our brain.

You have inherited an incredibly valuable bit of property. Will you rule and cultivate it? Will you rule over it? You better.”

Have a terrific weekend,

PW