Dear valued client,

The U.S. CPI report released this week showed prices rose 4.9% in April (down from 5% in March and 6% in Feb.), marking the 10th straight month of cooling and the first time inflation dropped below 5% in the last two years.

The Producer Price Index also showed price easing – down to 2.3% in April compared to 3.6% in March. Investors, however, demonstrated caution this week (markets down 0.3%) and are keeping an eye on a sustained rebound in the banking sector as well as a resolution to the U.S. debt ceiling debate.

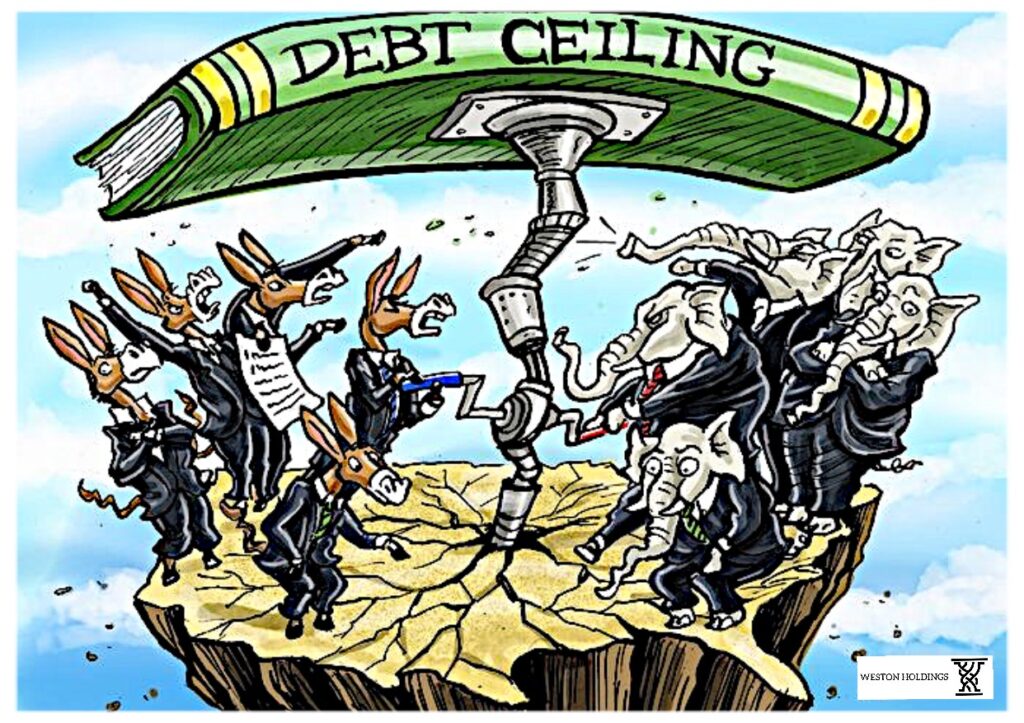

What is the U.S. Debt Ceiling?

The debt ceiling is a legislative limit on the amount of national debt that can be incurred by the finance department of the U.S. government. It dictates how much money the federal government may borrow. In other words, the debt ceiling is a boundary that limits the U.S. from borrowing more money to make their loan payments. If this sounds unsustainable, it’s because it is… borrowing more money to pay for already borrowed money is a fool’s errand. However, it is needed in the short term as much of the U.S. debt is in the form of bonds bought by foreign governments, corporations, and individual investors. If the United States defaults on its debt obligations (which has never happened before), it would send the value of the USD plummeting, creating a global financial disaster.

The Democrats obviously do not want this to happen on their watch, while the Republicans are requiring more assurances in regards to the government’s level of future spending. After all, much of the inflation we are experiencing today is a direct consequence of extravagant stimulus packages during Covid-19, which were largely paid for by printing more money.

I would be very surprised if a resolution is not sought in the coming weeks, but the details and intricacies of that resolution remain to be seen.

“Every time you borrow money, you’re robbing your future self.” – Nathan W. Morris

Have a terrific weekend,

PW