Dear valued client,

Markets dropped slightly this week after the release of vital economic news as well as tech corporate earnings.

The NASDAQ continued its 2023 climb as a handful of notable tech companies (Apple, Amazon, and Google) posted decent sales figures despite a rather turbulent economic environment. Wall Street especially liked Meta’s report showing revenue of over $32 billion. Their stock rose 20% on Thursday alone.

A considerable amount of attention this week centered on the Federal Open Market Committee’s 2-day meeting. The Fed announced a 0.25% basis point interest rate increase and markets responded positively as rate increases are diminishing. The Fed will likely increase rates again in their March meeting (likely by another 0.25 basis points). Their decision will depend on the incoming economic data in the interim.

The much-anticipated January unemployment report was released this morning indicating an addition of 517,000 jobs. This is both good and bad news. In short, it is good news because unemployment has fallen to 3.4%, its lowest in 53 years. The bad news is that it will likely keep interest rates higher for longer.

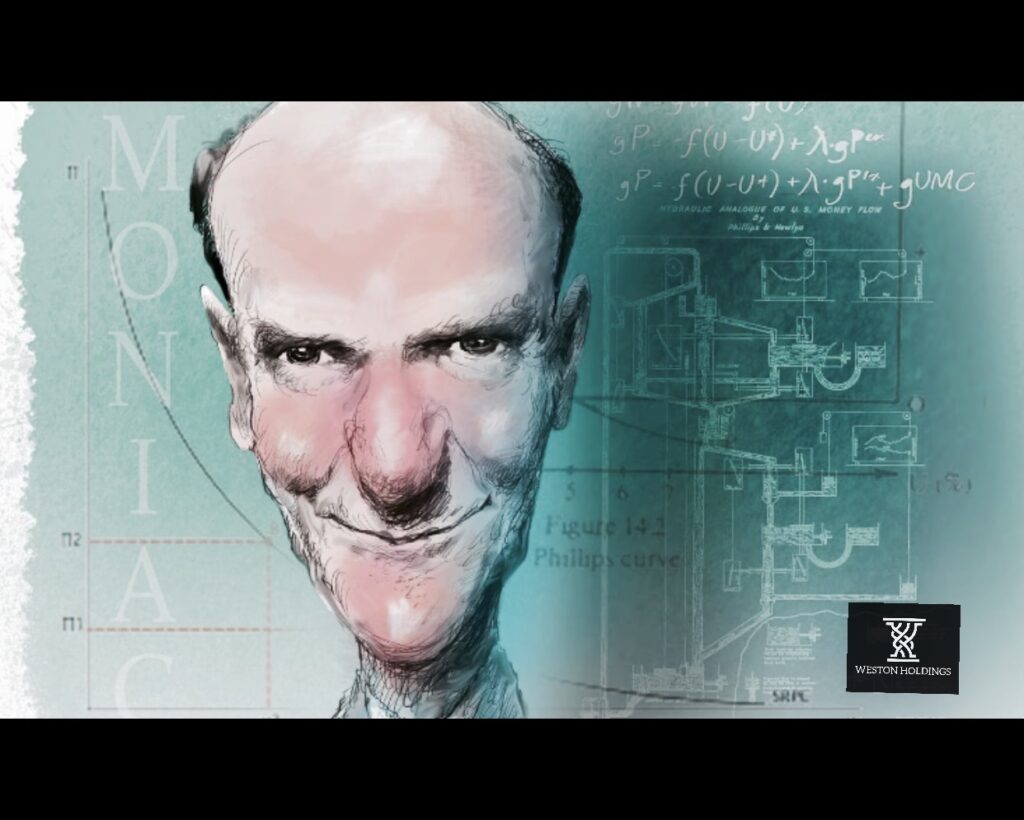

Why is the Federal Reserve so concerned with unemployment? The answer lies in an economic model developed by William Phillips, a New Zealand economist in 1958. He called it the Phillips Curve.

Phillips’ model states that inflation and unemployment have a stable and inverse relationship. With a booming economy comes more jobs and less unemployment, which in turn leads to rising prices. Therefore, by the same logic, as inflation decreases, unemployment will naturally increase.

What is the rationale behind the Fed wanting to see increased unemployment? First, it’s an indication that higher interest rates are having their desired effect. Second, with additional people out of work, the newly unemployed and their families will sharply pull back on their spending. Third, and most importantly, for most of the people still working, wage growth will flatline. The combination of rising prices and wage growth is the catalyst for “runaway inflation,” the last thing any of us want.

The first month of 2023 has been promising. Hopefully, it is an indication of how the rest of the year will unfold.

“Adversity makes men, and prosperity makes monsters.” – Victor Hugo

Have a terrific weekend,

PW