Dear valued client,

Markets showed encouraging signs this week. The major U.S. index increased by nearly three percentage points Wednesday through Thursday alone after investors parsed through surprisingly robust quarterly earnings reports from major companies including Tesla, CSX – a railroad transportation company, and ASML – a semiconductor company. Unemployment figures are back on par with what they were pre-pandemic (which likely won’t last) and energy prices have steadily decreased for several weeks in a row.

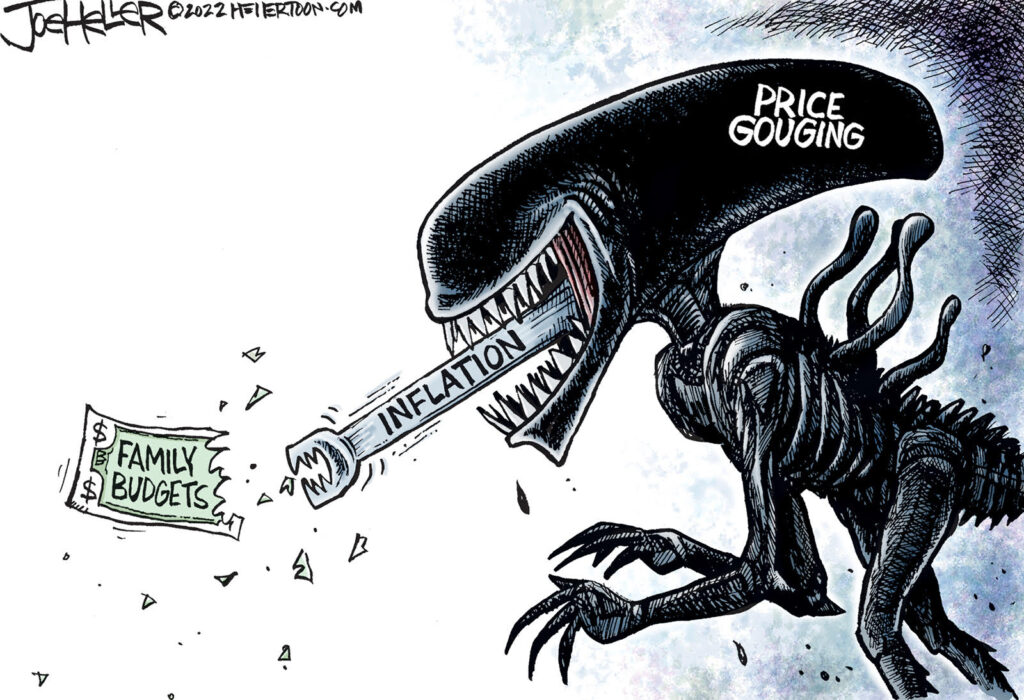

Despite the reasons for optimism, there remains one central looming factor applying downward pressure on markets… the monster chewing away at your purchasing power. His name is Inflation. Prices increased in Canada to 8.13% in June, up from 7.73% the month prior. With increasing interest rates, debt becomes more expensive. Given this reality, companies will attempt to maintain their profit margins in one of two ways (or both); increase prices for their products/services (which would only feed the monster of inflation), or lay off a portion of their employees. Many have already mentioned they will be doing the latter. For instance, Goldman Sachs said Monday it will likely reinstate annual performance reviews. The bank would let go of about 5% of its workers based on these reviews.

I’ve been in Italy for about a week now and there is much to be impressed by; the food, the wine, the scenery. I’ve been in absolute awe, however, of the myriad of cathedrals that seem to be on every other street corner. The Milan cathedral I visited took approximately 600 years to complete. It’s a testament to the Italian and European culture to persist with such long-term projects and to complete with them such detail and elegance.

“The one who plants trees, knowing he will never sit in their shade, has at least started to understand the meaning of life.” – Rabindranath Tagore

Have a terrific weekend,

PW