Dear valued client,

On Wednesday, the Federal Reserve announced it is raising interest rates by a half percentage point. This is the largest rate hike since 2000 and the first time since 2006 that rates are increased in back-to-back meetings. This demonstrates the degree to which the Fed is actively attempting to control inflation and the havoc it’s causing for people’s wallets and businesses’ balance sheets.

The response to COVID can be blamed for much of the inflation we are experiencing today; it was the catalyst that prompted political leaders to such down cities while simultaneously pumping capital into the economy for 18 or so months, diluting the value of the dollar (which is precisely what inflation is). The shutdowns and artificial influx of cash was the hurricane in the middle of the ocean, and the tsunami of inflation has hit us hard.

My hope last week was for the Fed to not take too aggressive an approach to rate hikes, as that would likely have a severe negative impact on companies’ earnings over the next quarters. Thankfully, after the half percentage increase was announced, there was also an indication that ruled out an even bigger rate increase in the near future. The market jumped roughly 3% on Wednesday after the news was released, only to drop back down 3-4% on Thursday. Investors remain cautious as we continue to deal with the war in Europe, unstable energy prices, and supply chain bottlenecks.

How do Central Banks raise interest rates?

In order to slow the economy down with the goal of taming inflation, Central Banks adjust what’s known as the ‘federal funds rate,’ which is the average interest rate that banks pay each other for overnight loans. Commercial banks borrow and lend money to each other to meet liquidity requirements set by regulators before the business day begins. When a bank has excess cash on hand, it can loan it out to another bank that needs it. By raising the cost of borrowing between banks, the Fed indirectly raises borrowing costs across the economy because those higher rates eventually filter down to consumers and businesses.

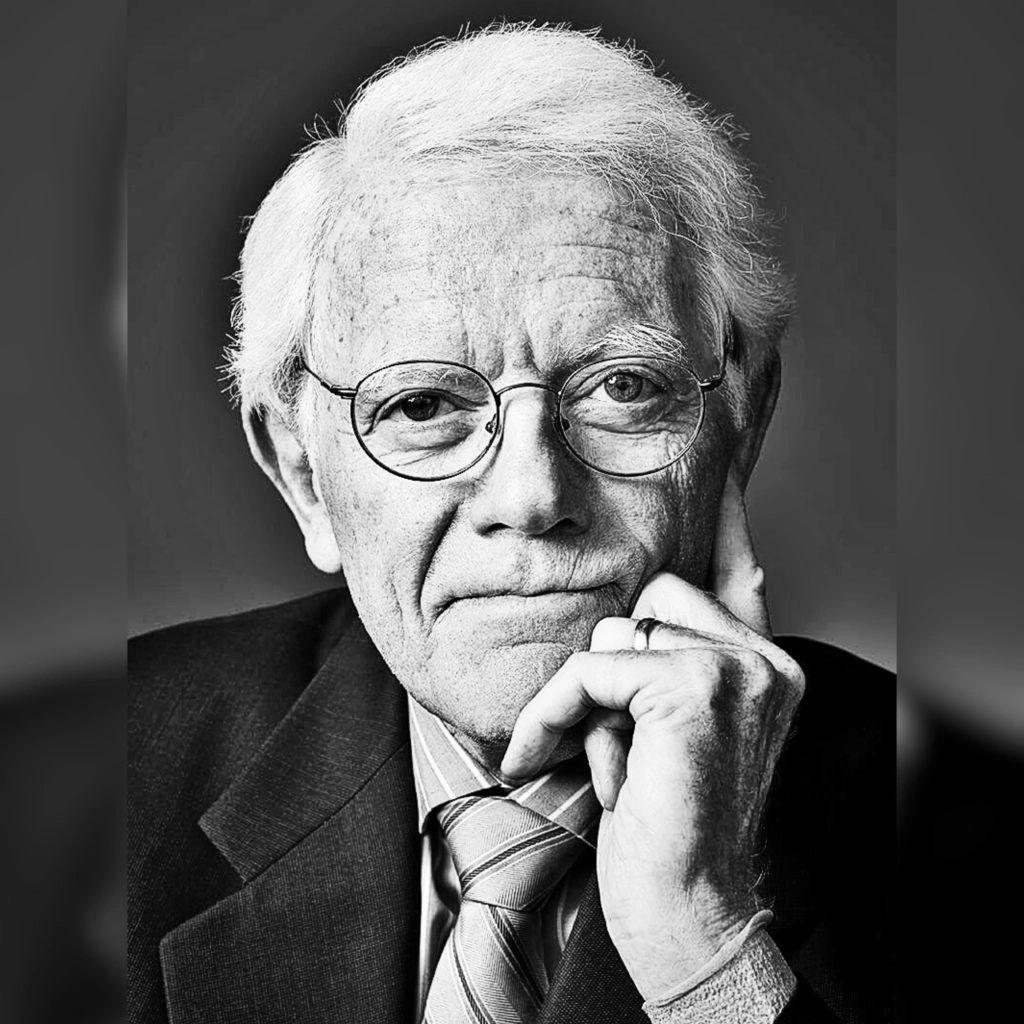

With the turbulent markets we have been experiencing since the beginning of 2022, I’d like to reiterate the advice from legendary Fidelity investor, Peter Lynch:

“Over the past 100 years, the market has had 50 declines of 10% or more. About once every two years the market drops 10%. Of those 50 declines, 15 have been 25% or more. So roughly every six years the market will have a decline of approximately 25%. Nobody knows when it’s going to happen.”

So far this year, markets are down roughly 10-12%. This is part and parcel of the investing world; you have to be able to stomach the declines in order to reap the benefits of asset growth.

Enjoy the beautiful weather forecasted in the next couple of days, summer is upon us!

Have a terrific weekend.

PW

“He who jumps off the rollercoaster in the middle of the ride is he who gets hurt.” – Dave Ramsey